The sorted Beta and Sharpe Ratio for all companies listed in the S&P 500 as of May 2021 are now available. Beta and Sharpe are calculated using 3 years of bi-weekly returns. To learn more about Beta and the Sharpe Ratio check out my post about measuring risk and return!

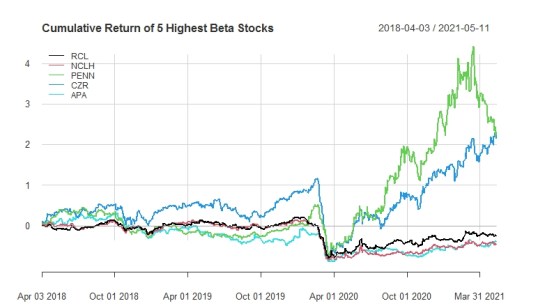

The 5 companies with the highest Beta are as follows:

- Norwegian Cruise Line Holdings Ltd. (NCLH)

- Royal Caribbean Group (RCL)

- Apache Corporation (APA)

- Caesars Entertainment Inc (CZR)

- Penn National Gaming, Inc (PENN)

After many months we’ve finally seen some turnover in the list of highest beta stocks. The cruise line stocks still feature prominently and have continued to lag the market badly. However, gaming stocks like Caesar’s Entertainment and Penn National Gaming have entered the list and their performance has been remarkably good. I personally found this result surprising; not that the gaming stocks are very high beta, but rather that their performance over the past year has been an order of magnitude better than the market. My perception had been that between the expense of running resorts and casinos and with Vegas witnessing a dramatic decline in patrons that these stocks would have been among the worst performers. It will be interesting to see how they fair as the reopening accelerates.

The 5 companies with the lowest Beta are as follows:

- Kroger (KR)

- The Clorox Company (CLX)

- Hormel Food Corporation (HRL)

- Cabot Oil & Gas (COG)

- The J.M. Smucker Company (SJM)

In contrast to the High Beta stocks, the constituents of the Low Beta stock list remain the same as they have for months. Clorox (an early pandemic winner) has seen its performance trail off markedly as the economy has reopened while Kroger and Hormel continue to grind higher. Smucker’s has seen its performance tick up as of late as value and dividend paying stocks have become in vogue during market volatility. Meanwhile, Cabot continues to struggle to find its footing even as oil and gas prices have rebounded.

The 5 companies with the highest Sharpe Ratio are as follows:

- Eli Lilly and Company (LLY)

- Microsoft Corp (MSFT)

- Enphase Energy (ENPH)

- West Pharmaceutical Services, Inc. (WST)

- Generac Holdings Inc. (GNRC)

The High Sharpe ratio plot continues to be dominated by Enphase Energy even despite the epic meltdown we have witnessed in the stock so far this year. It will be interesting to see if this stock drops out of the monthly list either due to poor performance or high volatility. A new addition to the list this month is Generac. The manufacturer of consumer and industrial generators, pumps and batteries was a top pandemic performer and continues to show strength in 2021.

The 5 companies with the lowest Sharpe Ratio are:

- Viatris Inc. (VTRS)

- Perrigo Company plc (PRGO)

- Schlumberger Limited (SLB)

- DXC Technology (DXC)

- NOV Inc. (NOV)

This month the low Sharpe Ratio stocks remain the same and continue to exhibit uniformly poor performance. Oil and gas field servicers Schlumberger and NOV have yet to rebound on the back of stronger oil and the increased drilling activity. While DXC has not been aided by the tail winds that tech stocks have faced YTD.

To download the updated Betas and Sharpe Ratios for the S&P 500 companies, click the buttons below!

Thanks for reading!

-Aric Lux.